Fragmented

Systems

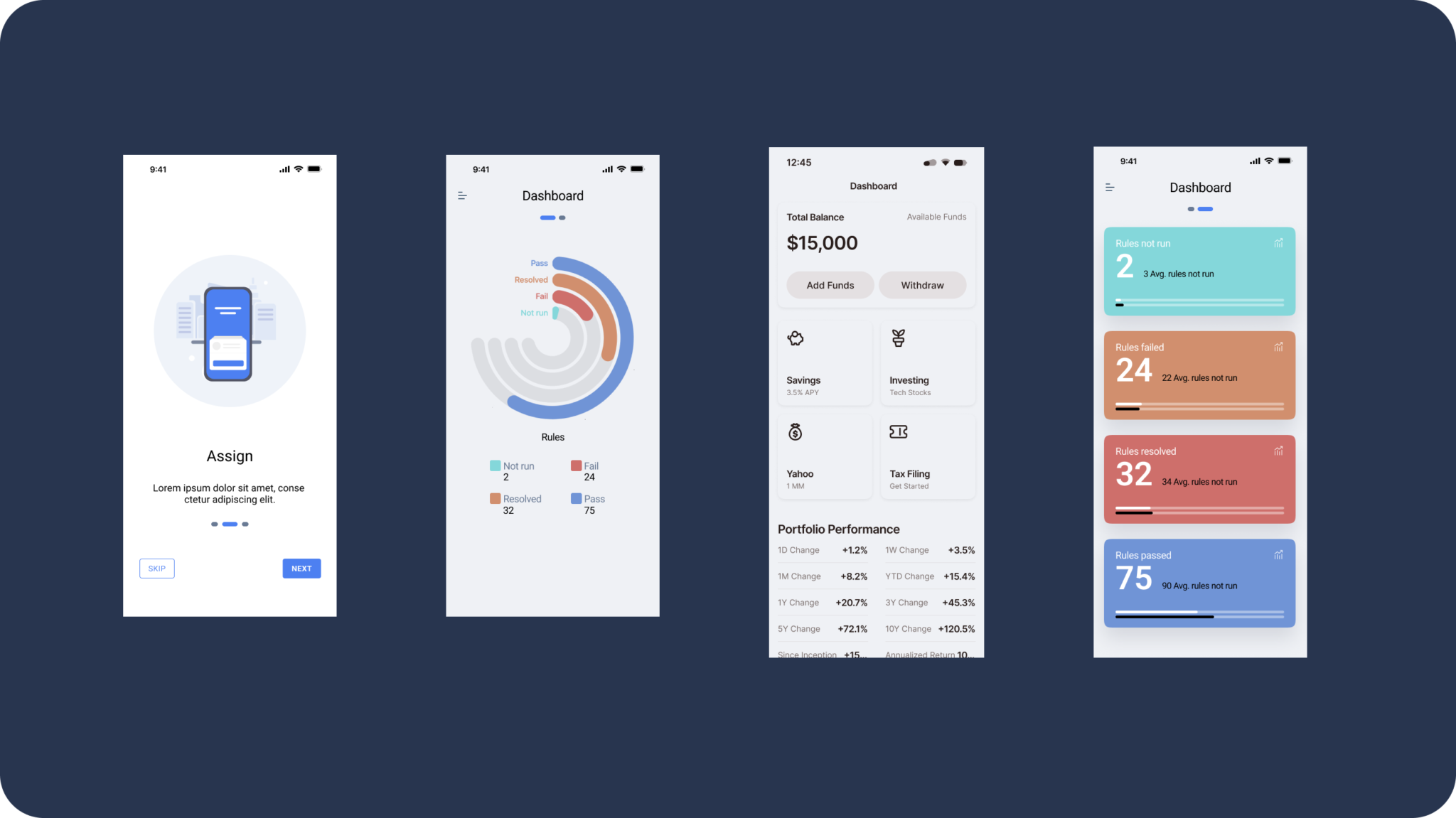

Onboarding

Inefficiencies

Overwhelming

Interface

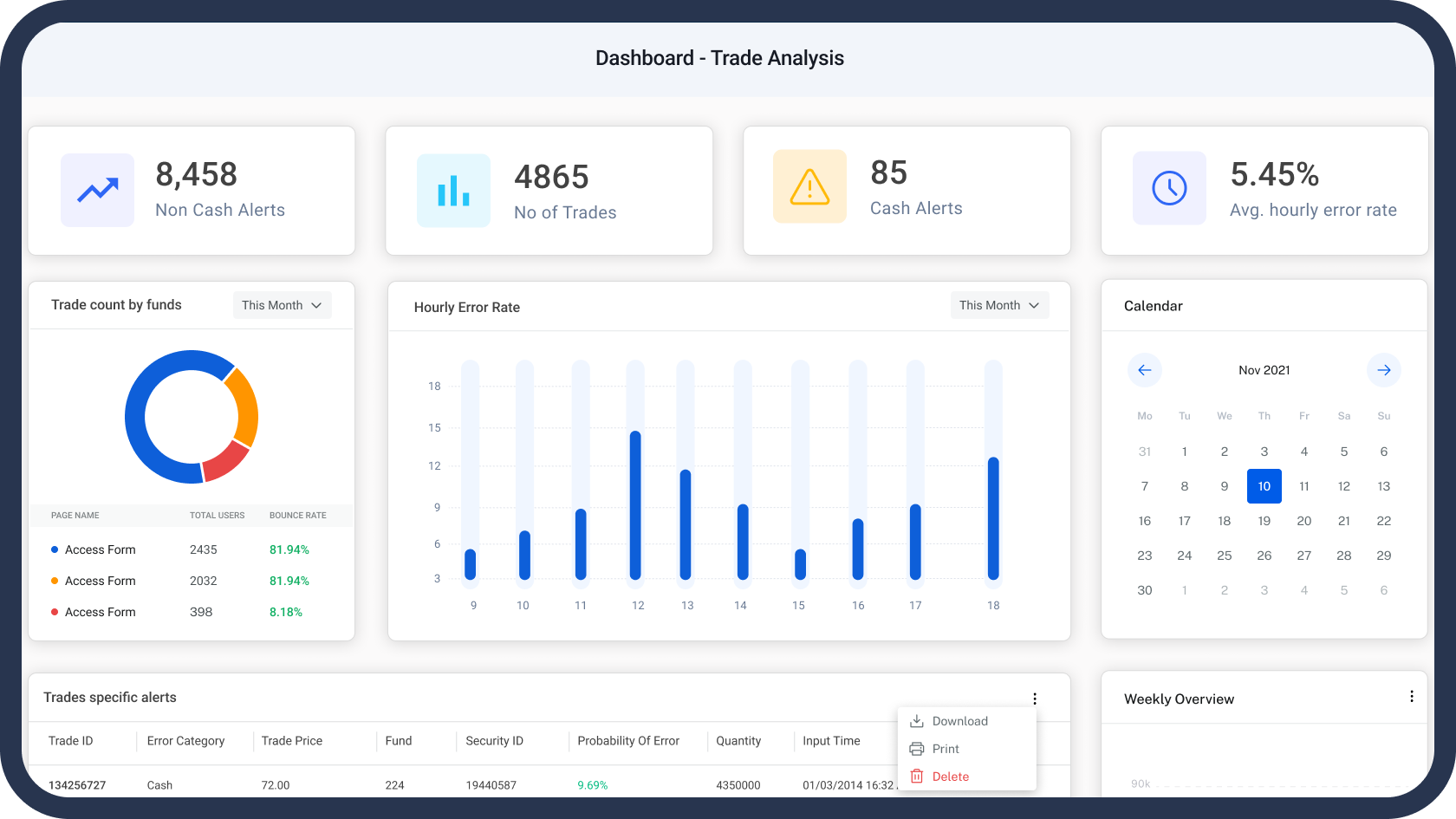

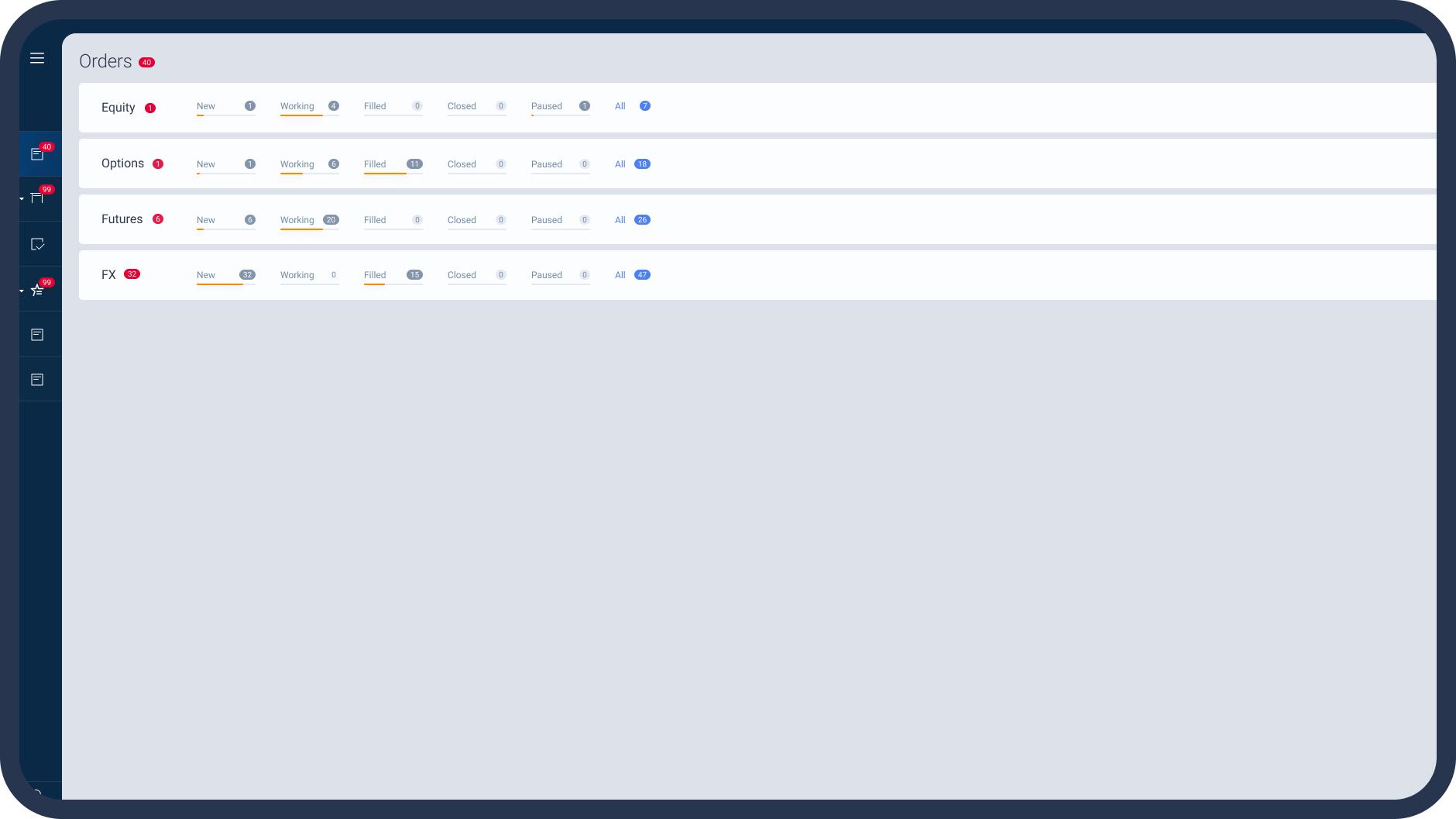

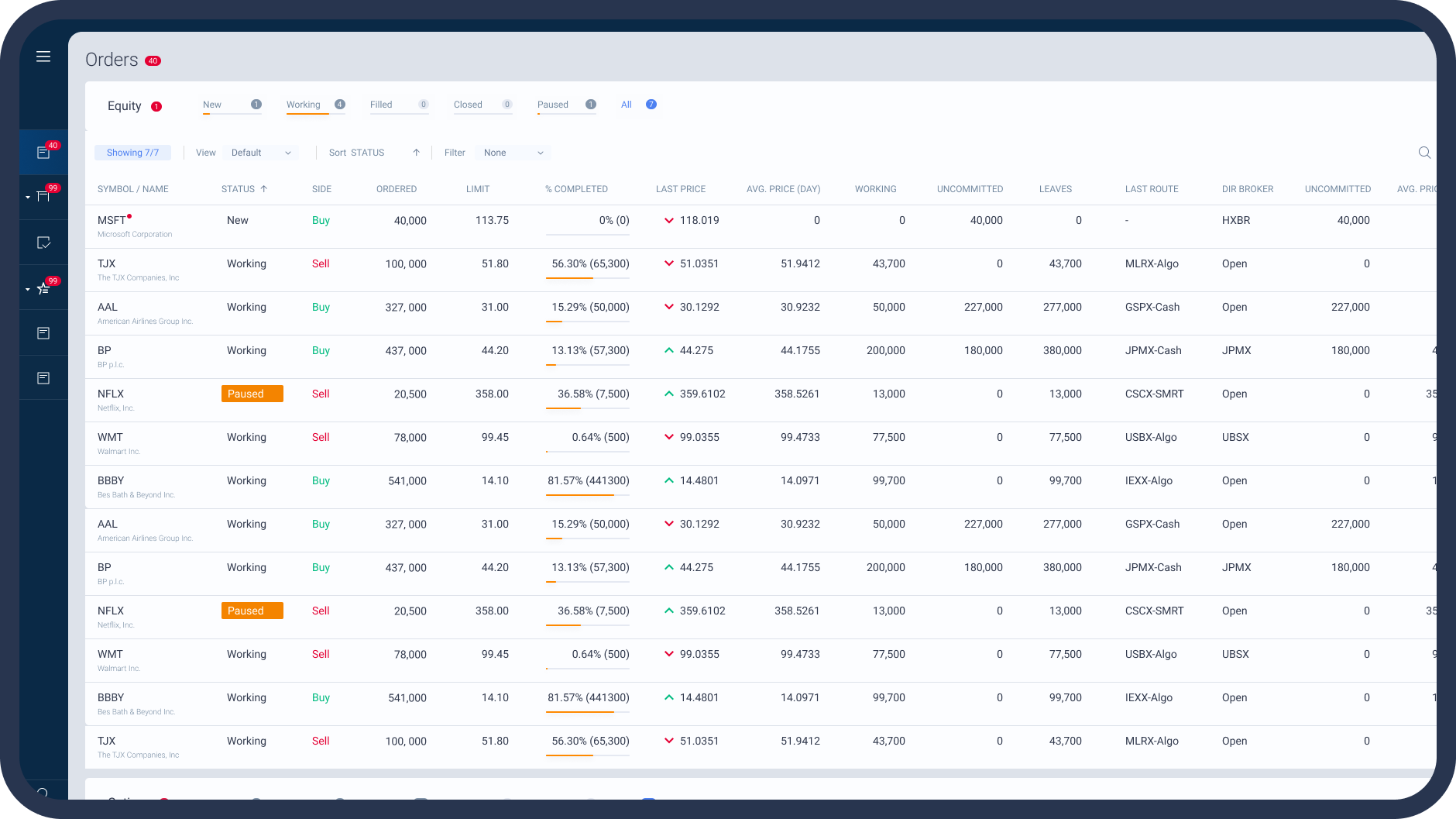

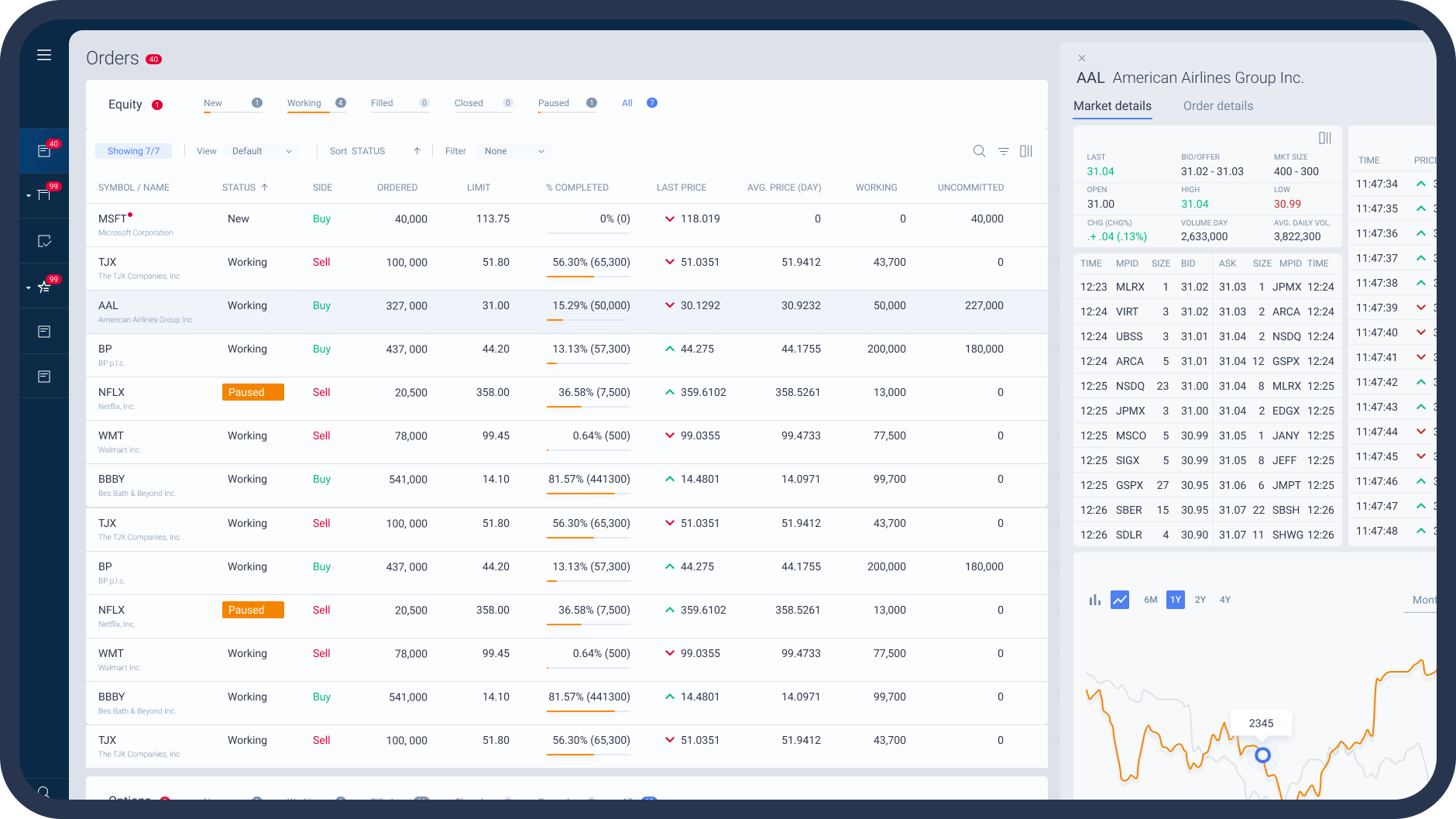

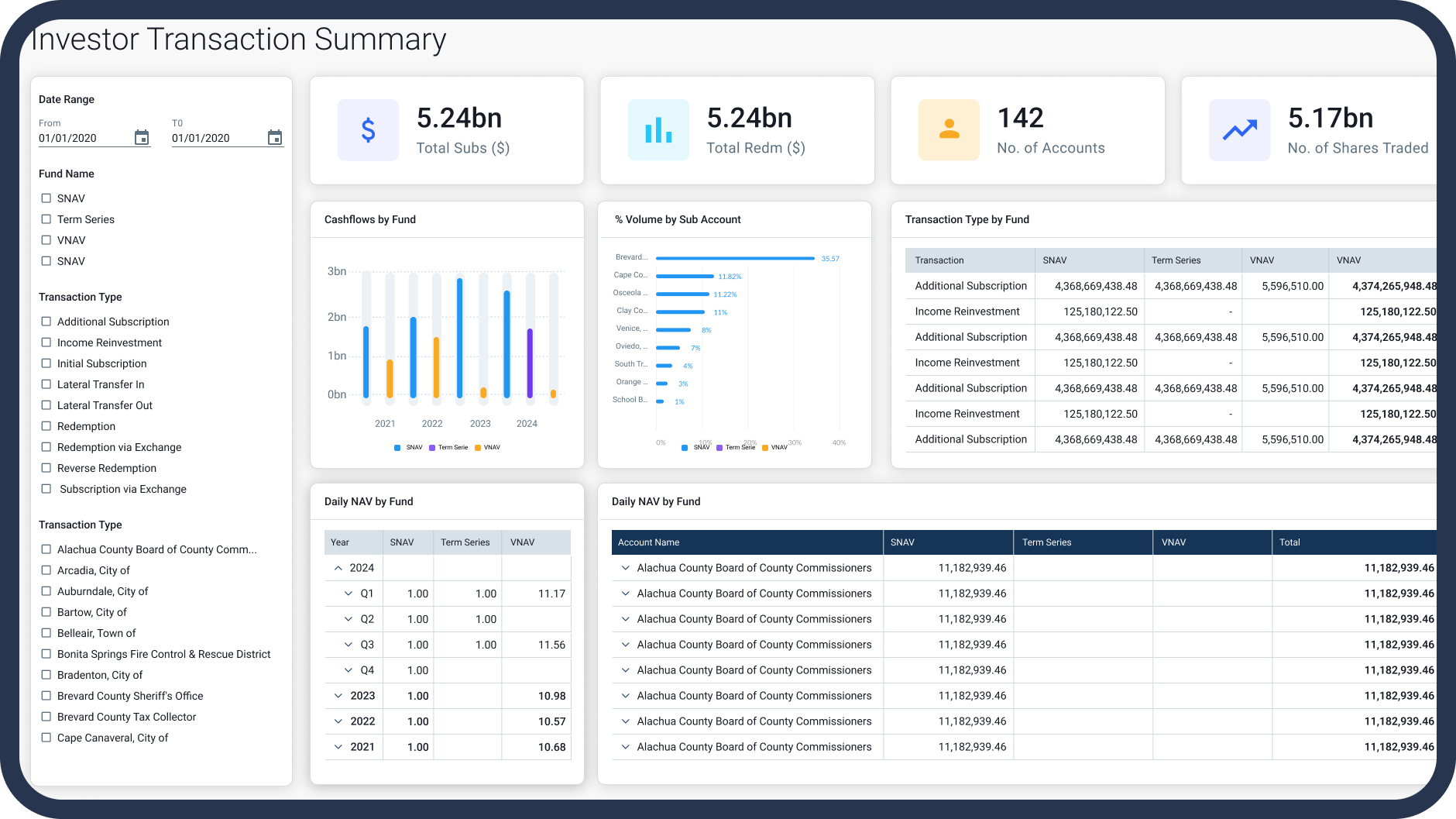

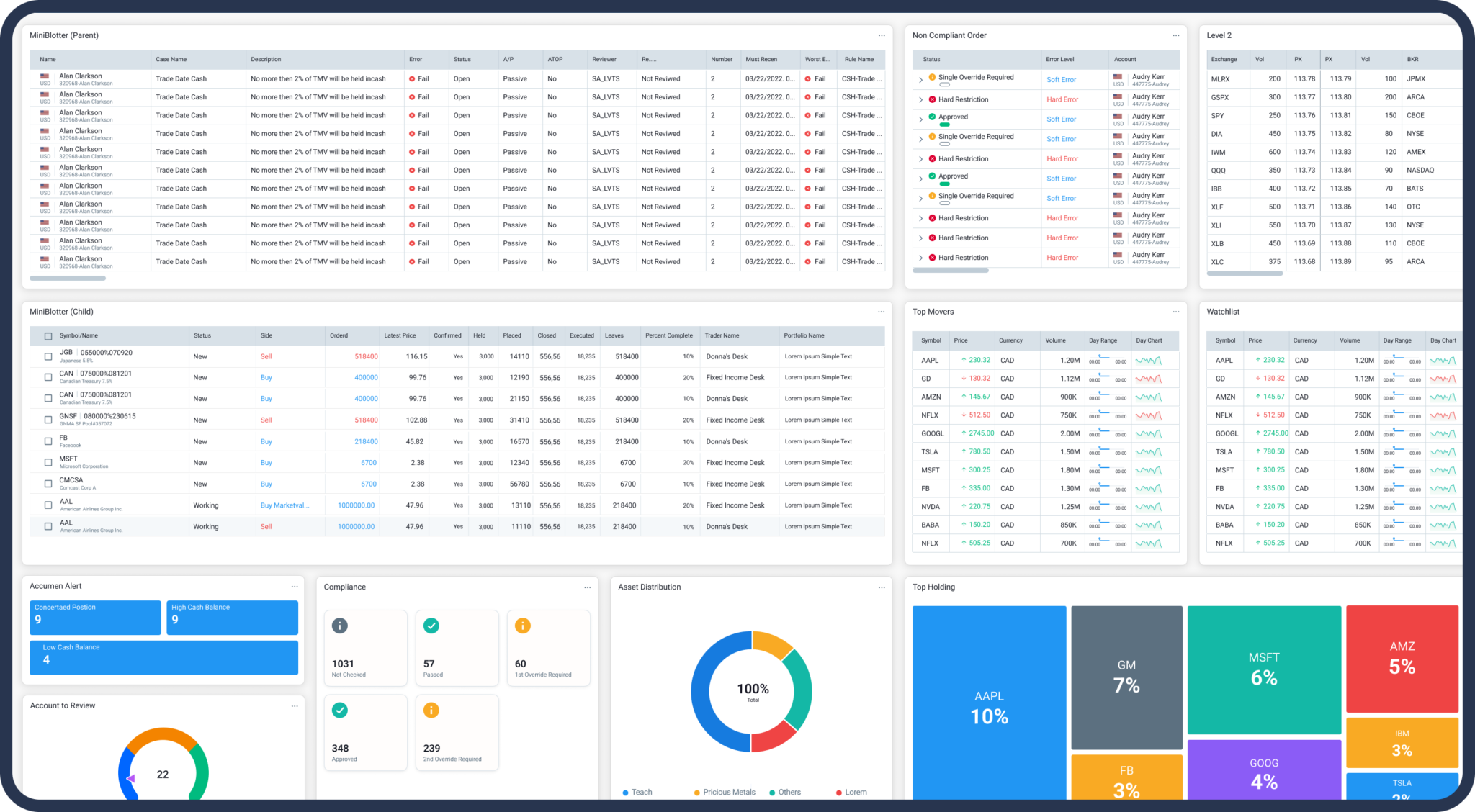

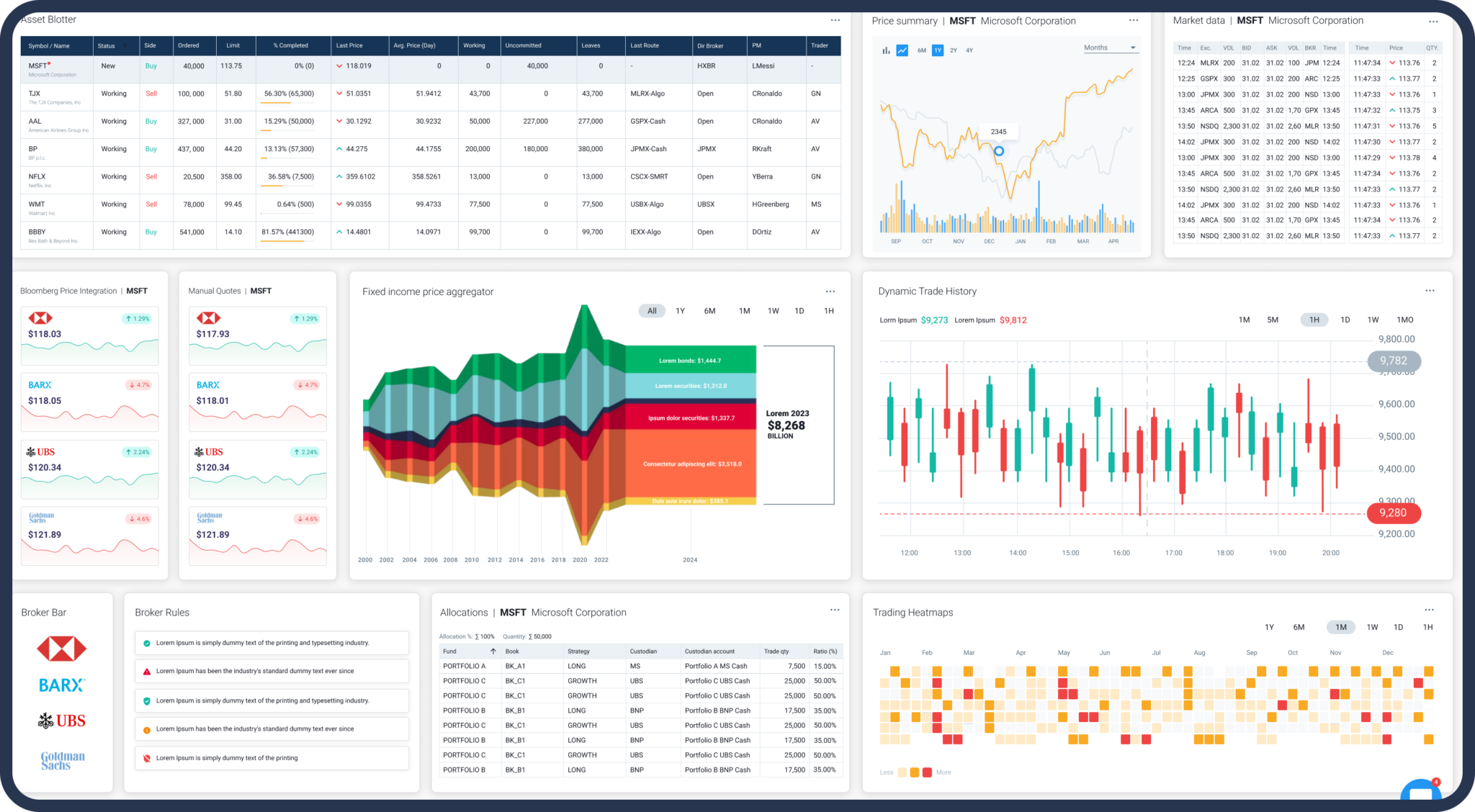

Co. OMS provided a single, cohesive platform that combined trading, portfolio management, and compliance functions.

Integrated AI-driven trading algorithms for real-time market analysis and decision-making.

Enabled automated trade execution and risk management, reducing manual intervention.

Improved predictive analytics for better trade optimization.

Integrated real-time alerts and automated workflows to reduce manual intervention.

System consolidation and workflow automation resulted in a notable decrease in operational expenses.

Enhanced trade execution speed and accuracy, improving investment performance.

AI-based risk assessment and predictive analytics helped advisors make data-driven decisions.

Faster Load Time

P1Co's OMS transformation significantly improved user experience by simplifying workflows, enhancing system usability, and integrating AI-driven trading for real-time decision-making. The solution empowered advisors with an intuitive, data-driven platform, leading to higher productivity, better client relationships, and long-term business growth.